Managing family finances has always been a crucial yet challenging aspect of household life. In the digital age, technology is stepping in to simplify this process. Financial applications, specifically designed for budgeting, are becoming indispensable tools for Americans striving to organize their expenses and meet financial goals.

From tracking spending habits to creating savings strategies, these apps are reshaping how families approach money management. In this article, we explore how financial apps are transforming budgeting for American families. We’ll examine the growing reliance on digital tools, their specific functionalities, and why they’re becoming essential for financial wellness.

The rise of financial apps in the United States

As technology advances, Americans are increasingly turning to financial apps to address their budgeting needs. These tools offer convenience, accessibility, and detailed insights that manual methods simply cannot match.

How financial apps gained popularity

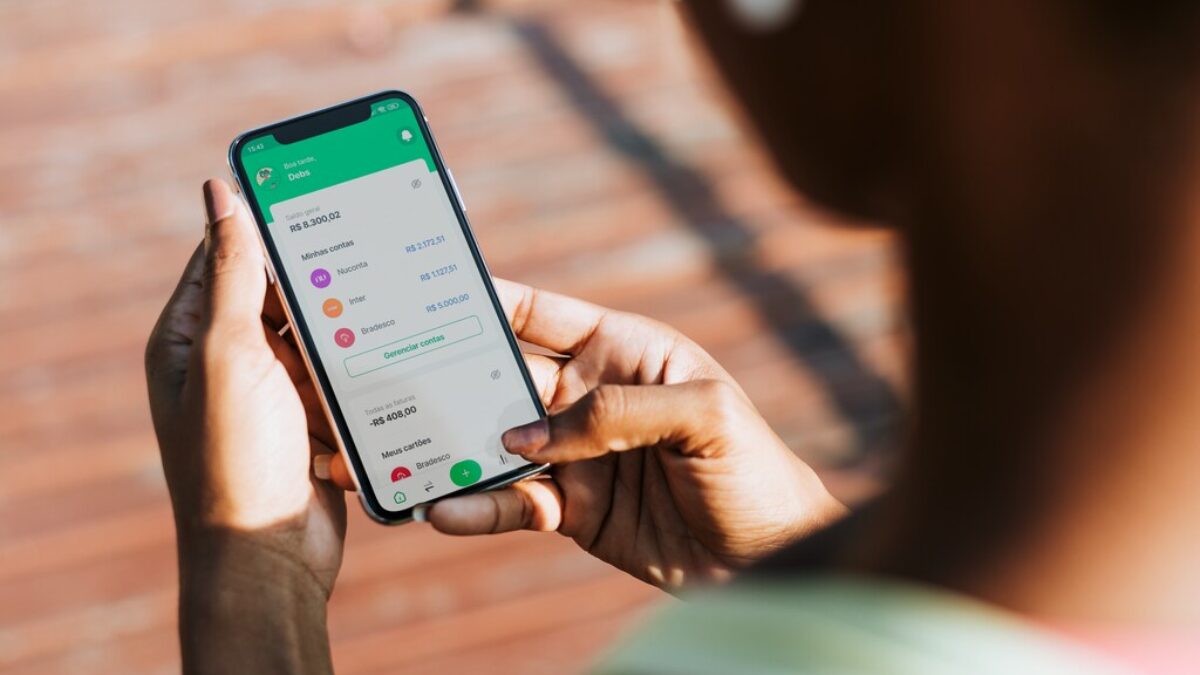

The widespread adoption of smartphones has been a significant catalyst for the popularity of financial apps. With mobile devices becoming an integral part of daily life, users now have access to real-time data at their fingertips. Whether monitoring account balances, setting spending limits, or receiving notifications for bill payments, these apps have redefined accessibility.

Moreover, the COVID-19 pandemic highlighted the importance of financial preparedness. With unexpected expenses and economic uncertainty, many families began seeking reliable ways to track their finances. Apps like Mint, YNAB (You Need a Budget), and PocketGuard rose in demand, offering structured budgeting and easy-to-use interfaces.

Features that make them indispensable

Financial apps come equipped with a wide range of features tailored to users’ needs. These include automatic categorization of expenses, which saves time and provides clarity on spending habits. Integration with bank accounts ensures seamless tracking of transactions, while customizable goals enable users to plan for future expenses, such as vacations or education.

The gamification aspect, such as earning rewards for meeting savings goals, also motivates families to stick to their budgets. These features, combined with robust security measures, are why Americans trust these apps for their financial management.

Essential functionalities of financial apps

Financial apps aren’t just about tracking expenses—they offer tools to analyze, strategize, and improve overall financial health.

Tools that analyze spending habits

Understanding where money goes is the first step toward better budgeting. Apps like Mint and Personal Capital provide breakdowns of spending categories, such as groceries, utilities, and entertainment. With visual aids like charts and graphs, users can pinpoint areas where they might be overspending and make adjustments accordingly.

Some apps even include AI-powered insights. These insights identify spending patterns and suggest actionable changes, such as reducing discretionary spending or negotiating subscription costs. This personalized approach makes financial management less intimidating and more effective.

Advanced savings strategies for families

Savings play a pivotal role in maintaining healthy family budgets and achieving financial security. Financial apps simplify this process by automating savings, often setting aside small, manageable amounts from each paycheck into designated accounts.

Apps like Qapital and Digit go beyond basic automation, leveraging algorithms to analyze spending patterns and allocate savings based on what users can comfortably afford without disrupting their daily lives. For families with specific goals, such as building a college fund, planning a vacation, or even buying a home, these apps introduce features like “goal buckets.”

These visual savings trackers allow users to create clear targets and monitor progress in real-time. By breaking down large financial goals into smaller, achievable milestones, these tools not only maintain motivation but also provide a tangible sense of accomplishment as each step is completed.

Moreover, these apps offer flexibility to adjust contributions, ensuring they remain aligned with changing financial circumstances. With the added convenience of automated reminders and regular updates, families can stay focused on their objectives while minimizing the stress of manual tracking. As a result, these apps not only streamline the savings process but also instill discipline, making it easier for families to achieve their short- and long-term financial aspirations.

Why more families are embracing financial apps

The shift toward financial apps goes beyond convenience—it’s about creating stability and empowering families to take control of their finances.

Enhanced transparency and accountability

Financial apps introduce a new level of transparency into family budgets, making it easier for households to stay organized and accountable. By using shared accounts and detailed expense tracking features, these apps ensure that all family members are aware of spending limits and financial goals. This shared visibility not only helps avoid unnecessary disputes but also promotes collaboration when managing household expenses.

For instance, apps like Honeydue are specifically designed for couples, offering tools to split bills, track joint expenses, and set mutual savings goals. This fosters open communication and helps families work together toward achieving financial stability and shared objectives.

Tailored budgeting solutions

No two families share the same financial needs, and this is where financial apps truly shine. These tools are designed to offer customizable features that adapt to various financial situations, ensuring they cater to the specific challenges each household faces.

Whether it’s creating a budget for a single-income household, tracking irregular earnings from freelance work, or managing the dual demands of repaying student loans while covering childcare expenses, these apps provide flexible solutions.

Educational value for younger generations

Financial literacy is an often-overlooked but highly significant benefit of financial apps. By involving children and teenagers in the budgeting process, parents have a unique opportunity to instill valuable lessons about money management early on. These lessons include understanding the importance of saving, distinguishing between needs and wants, and making informed spending decisions.

Apps like Greenlight are tailored specifically for younger users, offering a hands-on approach that combines practical financial education with real-world application. Features such as savings goals, spending limits, and allowances help young users develop responsible financial habits, laying the foundation for a lifetime of informed and confident money management.

Conclusion

The adoption of financial apps is more than a trend; it’s a shift toward smarter and more efficient money management. As these tools continue to evolve, they are empowering American families to make informed financial decisions, achieve their goals, and navigate economic uncertainties with confidence.

Whether it’s simplifying expenses, setting savings targets, or promoting financial education, the impact of these apps is profound and far-reaching. With countless options available, there’s an app for every family looking to take charge of their budget and secure a brighter financial future.